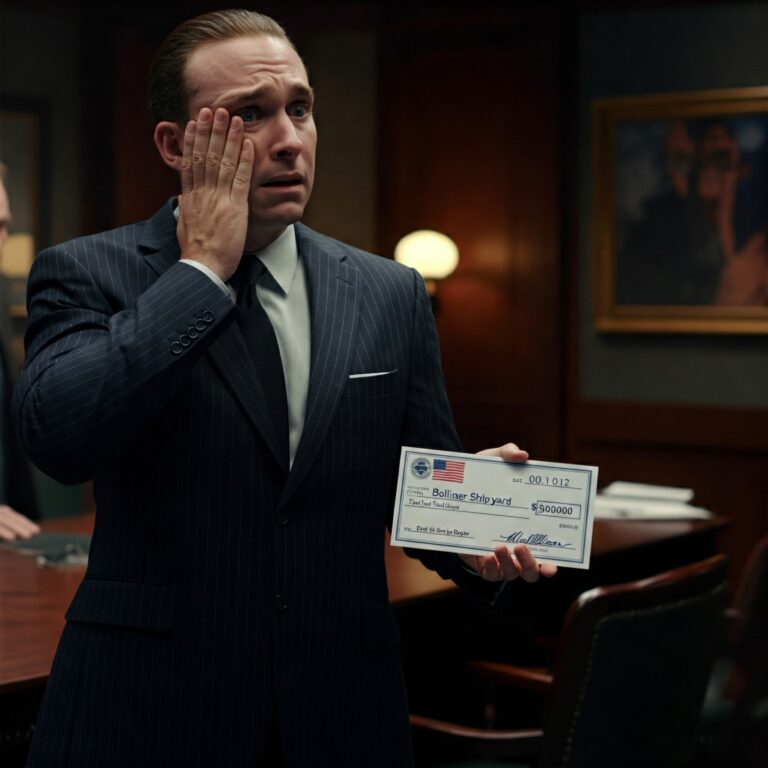

Lockport, Louisiana-based Bollinger Shipyard LLC has agreed to a $1,025,000 settlement to resolve allegations of violating the False Claims Act by knowingly employing and billing the U.S. Coast Guard for labor from unauthorized workers.

This case highlights the critical importance of compliance with federal contracting regulations, particularly those concerning employment eligibility verification. Let’s delve deeper into the details of this settlement and its implications.

The Allegations:

The U.S. government alleged that between 2015 and 2020, Bollinger Shipyard, a major vessel manufacturer for the U.S. Coast Guard, knowingly billed for labor provided by employees ineligible to work in the United States. Specifically, Bollinger was contracted to build Fast Response Cutters (FRCs) for the Coast Guard. These contracts mandated that Bollinger verify the employment eligibility of all personnel working on the project.

The government’s investigation revealed that Bollinger failed to comply with this crucial requirement, resulting in several ineligible individuals being employed and their labor billed to the Coast Guard. This constitutes a violation of the False Claims Act, which prohibits knowingly submitting false or fraudulent claims for payment to the government.

The Settlement and Its Implications:

Bollinger Shipyard has agreed to pay $1,025,000 to settle these allegations. This settlement underscores the government’s commitment to holding federal contractors accountable for compliance with contractual obligations and employment eligibility laws.

Key Takeaways for Federal Contractors:

- Rigorous Employment Verification: Federal contractors must implement robust employment verification procedures to ensure all employees are legally authorized to work in the United States. This includes utilizing the E-Verify system, a web-based tool that allows employers to confirm the eligibility of their employees.

- Contractual Compliance: Understanding and adhering to all contractual obligations is paramount. Failure to comply, especially with clauses related to employment eligibility, can lead to severe legal and financial consequences.

- Whistleblower Protections: The False Claims Act empowers whistleblowers to report fraud against the government. Companies should foster a culture of compliance and encourage employees to report any suspected wrongdoing without fear of retaliation.

The Importance of the False Claims Act:

The False Claims Act is a critical tool in combating fraud against the government. It allows the government to recover significant financial losses caused by fraudulent activities and serves as a powerful deterrent.

A Broader Perspective:

This case is not an isolated incident. The Department of Justice has been increasingly focused on pursuing False Claims Act violations, particularly in industries like shipbuilding and defense contracting. This trend signifies the government’s commitment to safeguarding taxpayer funds and ensuring the integrity of federal programs.

Looking Ahead:

This settlement serves as a stark reminder for all federal contractors to prioritize compliance and implement robust internal controls. Proactive measures to prevent violations are essential to avoid costly legal battles and reputational damage.

Beyond the Financial Implications:

Beyond the financial penalty, this settlement could have lasting consequences for Bollinger Shipyard. It may impact their ability to secure future government contracts and damage their reputation within the industry.

The Role of Government Agencies:

The Department of Homeland Security’s Office of Inspector General (DHS OIG) and the Coast Guard Investigative Service (CGIS) played crucial roles in the investigation. This highlights the collaborative efforts of government agencies in identifying and pursuing False Claims Act violations.

Conclusion:

The Bollinger Shipyard settlement serves as a valuable lesson for all federal contractors. Strict adherence to contractual obligations, particularly those related to employment eligibility, is non-negotiable. Implementing comprehensive compliance programs and fostering a culture of ethical conduct are vital steps in mitigating the risk of False Claims Act violations.