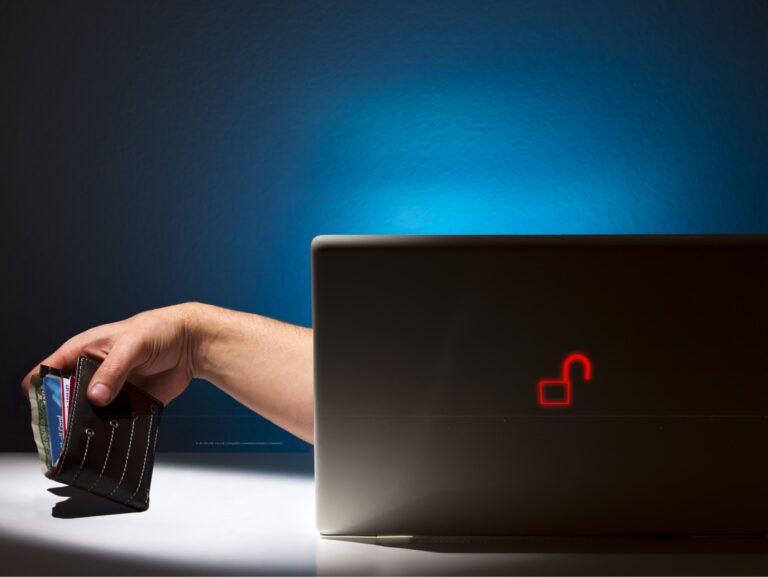

Credit Card Fraud Prevention

Credit card fraud has recently grown at an alarming rate around the globe, with online transactions accounting for a high percentage of fraudulent purchases. In fact, online credit card fraud is expected to increase to an estimated $190 billion by 2014, according to financial experts. This is a worrying statistic considering the detailed research and efforts from major credit card companies such Visa, and MasterCard to prevent this fraud. Credit card fraud is typically defined as the purchasing of a product or service from personnel not connected or associated with the specific credit card making the transaction. Therefore the merchant is tricked into releasing merchandise or rendering services to a false identity. The growth of credit card fraud is still growing at an astonishing rate, and this is expected to continue in the near future.

With the statistics highlighted above, credit card fraud is undoubtedly a problem and dilemma within today’s society. Therefore this short article has been designed to provide expert advice and helpful practices in order to minimize the possibility of credit card fraud in the future. Subjects such as securing bank account information, keeping credit cards safe, frequently checking statements, and always verifying your visa card will be discussed. Other valuable tips include never giving your PIN number or bank passwords to anybody, signing the back of the credit card instantly, and never throwing your statements in the bin without shredding the content first.

The most common method used by fraudsters is targeting cards and credit card details, either in conversation, in offline shops, or via insecure online transactions.

As a credit card holder, you must never hand over valuable card or bank account information to anybody, which includes cold callers, unsolicited phone calls, or in e-mail content (known as phishing). Therefore you should always keep your credit card out of a potential fraudster’s sight, never write down your pin number, and always keep your credit card in a secure place.

Most Internet, phone, and mail order fraud happens because card details are stolen in the real world, whether it is a shopping centre, street corner, workplace, or at home. With this statement in mind, the importance of never letting your credit card out of sight holds even more significance. Also, despite the introduction of CHIP and PIN, you still have a signature strip on your card which should always be signed as an extra precaution.

The above paragraphs have presented advice on how to keep your credit card safe and secure. However similar to consultants, fraudster’s are experts in their field and can gain information from the smallest opportunity presented to them. Therefore you must check your bank statements at regular intervals, either online or through monthly paper records. Once you receive your statement, make sure you check the account for irregular and false transactions. If the statement presents these fraudulent transactions, contact your bank or card company immediately and inform them of this illegal activity.

As highlighted above, a high majority of credit card fraud occurs online; therefore the next part of the article will discuss specific details integrating this area. Increasingly when online transactions are utilised, most websites provide the option of signing-up to a payment scheme that involves a password. Two permanent schemes include Verified by Visa and MasterCard Securecode. By signing up to these specific offerings, you will prevent fraudster’s using your credit card on particular sites as they will be unaware of your password.

Other helpful tips include only shopping at secure websites by ensuring the unlocked padlock or unbroken key symbol is showing at the bottom of your browser window. Additionally the retailer’s internet address should change from a ‘http’ to a ‘https’ when a purchase is made using a secure connection. Also you should only ever use a protected computer with an up-to-date virus software and firewall installed.