Introduction

Credit repair scams are on the rise, with scammers consistently coming up with new ways to target unsuspecting victims. In this comprehensive guide, we will discuss the top 10 types of credit repair scams, how to prevent falling victim to them, and how to report them if you or someone you know has been targeted.

1. Advance Fee Scams

Advance fee scams involve a scammer promising to improve your credit score in exchange for an upfront fee. They often claim to be able to remove negative items from your credit report, such as late payments, bankruptcies, and foreclosures. After receiving the fee, the scammer either disappears or fails to deliver on their promises.

Prevention

- Always be skeptical of anyone who promises to improve your credit score in exchange for an upfront fee.

- Avoid working with credit repair companies that demand payment before providing services.

- Research the company online and check for reviews or complaints with the Better Business Bureau (BBB).

Reporting

- Report advance fee scams to the Federal Trade Commission (FTC) at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

2. Fake Credit Repair Companies

Fake credit repair companies pretend to be legitimate businesses to gain your trust and access your personal information. They may use a professional-looking website, a local phone number, and even fake customer testimonials to appear credible.

Prevention

- Do not trust a company solely based on their website or online presence.

- Verify the company’s phone number and physical address.

- Check for customer reviews and complaints on the BBB website.

- Be cautious of companies that use aggressive sales tactics or pressure you to sign up for their services.

Reporting

- Report fake credit repair companies to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

3. Credit Card Piggybacking Scams

Credit card piggybacking involves adding someone as an authorized user on a credit card account to boost their credit score. Scammers may offer to add you to an account with a high credit limit and perfect payment history in exchange for a fee. However, they may add you to an account with negative history or not add you at all after receiving payment.

Prevention

- Be skeptical of anyone offering to improve your credit score quickly through piggybacking.

- Remember that building credit takes time and effort, and there are no shortcuts.

- Learn about legitimate ways to improve your credit score, such as paying your bills on time, paying down debt, and disputing inaccuracies on your credit report.

Reporting

- Report credit card piggybacking scams to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

4. Identity Theft Scams

Identity theft scams involve someone using your personal information, like your Social Security number and date of birth, to apply for credit in your name. In some cases, scammers may pose as credit repair specialists to trick you into providing your personal information.

Prevention

- Be cautious about sharing your personal information, especially online or over the phone.

- Regularly monitor your credit reports for unauthorized accounts or activity.

- Consider placing a fraud alert or credit freeze on your credit reports.

Reporting

- If you believe your identity has been stolen, report it to the FTC at identitytheft.gov.

- File a police report with your local law enforcement agency.

- Contact the three major credit bureaus (Equifax, Experian, and TransUnion) to dispute fraudulent accounts and place a fraud alert or credit freeze.

5. Credit Repair Software Scams

Scammers may sell fraudulent credit repair software that promises to automate the process of repairing your credit. These programs typically do not work and may even contain malware that can steal your personal information.

Prevention

- Be cautious of websites or advertisements promoting credit repair software.

- Research the software and its developer to ensure its legitimacy.

- Consider using a reputable credit repair service or repairing your credit on your own.

Reporting

- Report credit repair software scams to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

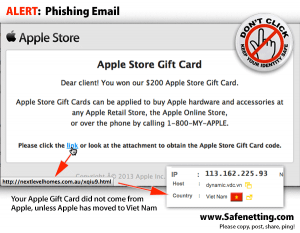

6. Phishing Scams

Phishing scams involve scammers posing as a legitimate company to trick you into providing personal information, such as your Social Security number, credit card number, or login credentials. They may send emails, text messages, or make phone calls pretending to be from a credit repair company, bank, or credit bureau.

Prevention

- Be cautious of unsolicited emails, texts, or phone calls requesting personal information.

- Verify the identity of the sender or caller before providing any information.

- Look for signs of phishing, such as poor grammar, misspelled words, or suspicious links.

Reporting

- Report phishing scams to the FTC at ftc.gov/complaint.

- Forward phishing emails tothe Anti-Phishing Working Group at reportphishing@apwg.org.

- Report phishing text messages to your mobile carrier by forwarding them to SPAM (7726).

7. Debt Elimination Scams

Debt elimination scams involve scammers promising to eliminate your debt for a fee. They may claim to have a secret legal method or government program that can wipe out your debt. In reality, there is no such method or program, and the scammer simply takes your money without providing any service.

Prevention

- Be skeptical of anyone claiming they can eliminate your debt for a fee.

- Research the company or individual making the claims.

- Consider working with a reputable credit counselor or debt relief agency instead.

Reporting

- Report debt elimination scams to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

8. File Segregation Scams

File segregation scams involve creating a new credit identity for a consumer by obtaining a new Social Security number or Employer Identification Number (EIN). Scammers may promise to help you start over with a clean credit history, but using a false identity for credit purposes is illegal and can result in criminal charges.

Prevention

- Be cautious of anyone offering to create a new credit identity for you.

- Remember that it is illegal to use a false Social Security number or EIN for credit purposes.

- Work on repairing your credit through legitimate means, such as disputing inaccuracies and making timely payments.

Reporting

- Report file segregation scams to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

9. Credit Privacy Number (CPN) Scams

A Credit Privacy Number (CPN) is a nine-digit number that some claim can be used as a replacement for your Social Security number on credit applications. Scammers may sell CPNs to consumers with poor credit, promising a fresh start. However, using a CPN in place of your Social Security number is illegal and can result in criminal charges.

Prevention

- Be cautious of anyone offering to sell you a CPN.

- Remember that using a CPN in place of your Social Security number is illegal.

- Focus on improving your credit through legitimate methods.

Reporting

- Report CPN scams to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

10. Misleading Credit Repair Seminars

Scammers may host credit repair seminars, either in-person or online, promising to teach consumers how to repair their credit and eliminate debt. These seminars often charge high fees, provide misleading or illegal information, and fail to deliver on their promises.

Prevention

- Be cautious of credit repair seminars that charge high fees or promise quick results.

- Research the seminar and its organizers to ensure their legitimacy.

- Consider learning about credit repair through reputable sources, such as nonprofit credit counseling agencies or government websites.

Reporting

- Report misleading credit repair seminars to the FTC at ftc.gov/complaint.

- File a complaint with your state attorney general’s office.

Conclusion

Credit repair scams can be devastating for individuals who are already struggling with their finances. By understanding the most common types of scams, taking steps to prevent becoming a victim, and knowing how to report scams, you can protect yourself and others from these unscrupulous schemes. Remember, repairing your credit takes time and effort, and there are no shortcuts to building a healthy credit history.