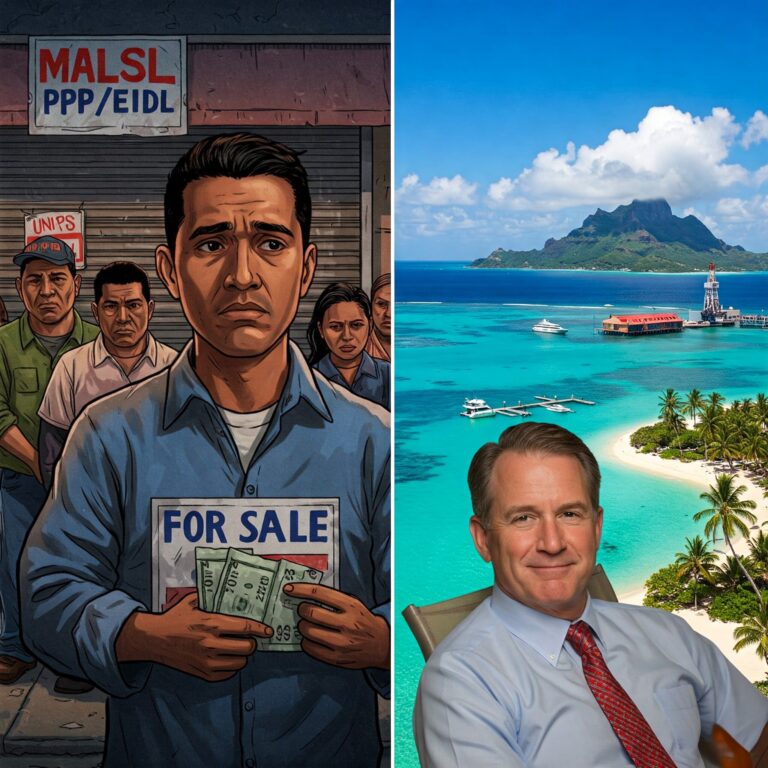

Elaborate Scheme Used Fake Payroll Data to Steal Millions in PPP and EIDL Funds

[Date of Publication – e.g., October 26, 2023] – In a stark reminder of the widespread fraud that plagued pandemic-era relief programs, a Florida man and a network of companies he controlled have been ordered to pay a staggering $20,074,458.70 for defrauding the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program. Patrick Walsh, the mastermind behind the scheme, is already serving a 66-month prison sentence for his crimes, highlighting the serious consequences of exploiting programs designed to help struggling businesses during the COVID-19 crisis.

This case, brought to light by a courageous whistleblower, underscores the critical role of individuals in exposing fraud and the power of the False Claims Act to hold perpetrators accountable. It also serves as a warning to others contemplating similar schemes: the government is actively pursuing and prosecuting those who abused these vital relief funds.

The Mechanics of the Fraud: A Web of Deceit

The Justice Department’s investigation revealed a meticulously planned and executed fraud that spanned multiple companies and involved significant falsification of information. Walsh, operating through 10 companies, systematically submitted fraudulent applications for both PPP and EIDL loans. These companies included:

- American Blimp Company LLC

- Walsh Family Land Corp.

- Airsign Inc.

- Airsign Airship Group LLC

- Airsign Group LLC

- Airsign Airships Latin America LLC

- Airsign Airships Asia Pacific LLC

- Airsign Airships Repair Station LLC

- Aero Capital LLC

- Eagle Ridge Management Group LLC (doing business as Shiloh Oil Company)

The core of the deception lay in inflating employee numbers and payroll expenses. Walsh submitted applications containing false information about the companies’ workforce and financial needs. In some cases, the entities for which he sought loans were either dormant or completely inactive, existing only on paper. This blatant misrepresentation allowed Walsh to secure approximately $7.8 million in loans to which he was not entitled.

To further amplify his gains, Walsh even submitted EIDL applications in his wife’s name, broadening the scope of the fraud and demonstrating a clear intent to maximize his illicit profits.

From Relief Funds to Luxury Purchases: Walsh’s Lavish Spending

The funds, intended to support struggling businesses and their employees, were instead diverted to Walsh’s personal enrichment. The investigation uncovered a shocking misuse of the loan proceeds, including:

- Purchase of a Private Island: A significant portion of the stolen funds was used to acquire a private island, a symbol of extravagant spending far removed from the intended purpose of the relief programs.

- Investment in Texas Oil Interests: Walsh channeled funds into personal investments, further demonstrating his disregard for the restrictions on the use of PPP and EIDL loan proceeds.

- Payment of Personal Debts: The fraudulently obtained money was used to settle personal financial obligations, highlighting the purely self-serving nature of the scheme.

This blatant misuse of funds intended for legitimate businesses during a time of national crisis underscores the audacity of Walsh’s actions.

The CARES Act: A Lifeline Abused

The PPP and EIDL programs were crucial components of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed by Congress in March 2020. These programs were designed as a lifeline for small businesses struggling to survive the economic fallout of the COVID-19 pandemic.

- Paycheck Protection Program (PPP): The PPP offered low-interest, forgivable loans to help businesses cover payroll costs, rent, utilities, and mortgage interest. The loans were guaranteed by the Small Business Administration (SBA), incentivizing lenders to participate.

- Economic Injury Disaster Loan (EIDL): The EIDL program provided low-interest loans directly from the SBA to businesses in declared disaster areas, offering crucial support for those facing economic hardship.

Both programs required applicants to certify their eligibility, including the number of employees and the intended use of the funds. Walsh’s deliberate misrepresentations on these applications constituted a direct violation of the False Claims Act.

The False Claims Act and the Whistleblower’s Role

The civil settlement in this case stems from a qui tam lawsuit filed under the False Claims Act. This powerful law allows private citizens, known as “whistleblowers” or “relators,” to sue on behalf of the government when they have evidence of fraud involving government funds.

In this instance, Andrew Hersh, who provided IT services for Walsh, stepped forward with crucial information about the fraudulent scheme. His courageous action initiated the investigation that ultimately led to Walsh’s conviction and the substantial civil judgment.

The False Claims Act incentivizes whistleblowers by allowing them to share in a portion of the government’s recovery. The exact amount Mr. Hersh will receive has not yet been determined, but it will likely be a significant sum, reflecting the value of his contribution to uncovering this large-scale fraud.

The case, captioned United States ex rel. Andrew Hersh v. Patrick Walsh et al., No. 1:20‑cv‑231 (N.D. Fla.), highlights the vital role whistleblowers play in combating fraud and protecting taxpayer dollars.

Justice Served: Criminal Conviction and Civil Judgment

Walsh’s fraudulent activities did not go unpunished. In January 2023, he pleaded guilty to one count of wire fraud and one count of money laundering. He was sentenced to 66 months in federal prison and ordered to pay $7.8 million in restitution, matching the amount of the fraudulent loans. A forfeiture order for the same amount was also entered.

The recent consent judgment, totaling $20,074,458.70, represents a significant civil penalty on top of the criminal penalties. This amount likely includes treble damages (three times the actual damages) and penalties, as allowed under the False Claims Act. This substantial financial burden, coupled with his prison sentence, sends a strong message that defrauding the government carries severe consequences.

Government’s Commitment to Pursuing Fraud

The statements from government officials involved in the case underscore the commitment to pursuing and prosecuting those who exploited pandemic relief programs.

“PPP and EIDL loans were intended to help small businesses during the pandemic,” said Acting Assistant Attorney General Yaakov M. Roth. “The department is committed to holding accountable those who undermined the purpose of these programs by knowingly obtaining and retaining loan proceeds for which they were not eligible.”

Acting United States Attorney Michelle Spaven for the Northern District of Florida emphasized the deterrent effect of the penalties: “Today’s civil resolution and the previously imposed 66-month period of incarceration should serve as a significant deterrent to others like the defendant who would attempt to steal millions of dollars from the American people and exploit Federal relief programs.”

Wendell Davis, General Counsel for the U.S. Small Business Administration, highlighted the SBA’s commitment to protecting taxpayer funds: “This settlement is a victory over bad actors seeking to exploit taxpayer-funded programs. SBA is committed to vigorously protecting the hard-earned money of the American people and ensuring that those who fraudulently obtain those funds are held accountable.”

These statements demonstrate a coordinated effort among various government agencies, including the Department of Justice and the SBA, to aggressively pursue fraud related to COVID-19 relief programs.

Implications and Lessons Learned

The Patrick Walsh case serves as a cautionary tale and offers several key takeaways:

- Vulnerability of Relief Programs: The case highlights the vulnerability of large-scale government relief programs to fraud, particularly during times of crisis when speed and efficiency are prioritized.

- Importance of Whistleblowers: The crucial role of whistleblowers in uncovering fraud is undeniable. Individuals with inside information are often the best defense against complex schemes.

- Deterrent Effect of Strong Enforcement: The severe penalties imposed on Walsh, both criminal and civil, serve as a strong deterrent to others who might be tempted to engage in similar fraudulent activities.

- Ongoing Government Scrutiny: The government’s continued pursuit of PPP and EIDL fraud cases demonstrates that these investigations are ongoing and that perpetrators will be held accountable, even years after the initial fraud occurred.

- Need for Enhanced Oversight: The case underscores the need for robust oversight and verification mechanisms to prevent fraud in future government programs.

Protecting Yourself and Your Business from Fraud

For businesses and individuals, this case serves as a reminder of the importance of vigilance and ethical conduct. Here are some steps to protect yourself:

- Know the Rules: Thoroughly understand the eligibility requirements and restrictions of any government program you participate in.

- Maintain Accurate Records: Keep meticulous records of all financial transactions and documentation related to government loans or grants.

- Be Wary of “Too Good to Be True” Offers: Be skeptical of any offers or schemes that seem too easy or promise unrealistic returns.

- Report Suspicious Activity: If you suspect fraud, report it to the appropriate authorities. The SBA Office of Inspector General and the Department of Justice have dedicated hotlines and reporting mechanisms.

- Consult with legal professionals: If you are thinking of using this programs, or being acused.

Conclusion: A Victory for Taxpayers and a Warning to Fraudsters

The Patrick Walsh case represents a significant victory for taxpayers and a powerful warning to those who would seek to exploit government programs for personal gain. The combined efforts of a courageous whistleblower, diligent investigators, and committed prosecutors have resulted in substantial financial penalties and a lengthy prison sentence. This case serves as a reminder that fraud will be detected, prosecuted, and punished, and that the government is dedicated to protecting the integrity of vital relief programs. The ongoing efforts to uncover and prosecute PPP and EIDL fraud will continue to be a priority for law enforcement, ensuring that those who abused the system are held accountable.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute legal advice. 1 If you have any concerns about potential fraud or legal matters, please consult with a qualified professional.