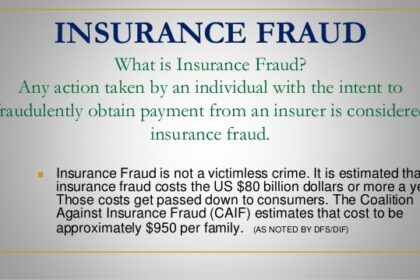

Health insurance fraud represents one of America’s largest taxpayer rip-offs ever, costing Americans literally billions of dollars every year.

Due to rampant deception, scams and abuse in the health care system, consumers are forced to pay the price–literally–through escalating medical costs and rising health insurance premiums.

And government programs like Medicare and Medicaid, designed to help the low-income and elderly, represent two of the biggest losers of all.

Health Insurance Scams

According to the Insurance Information Institute, health providers and facilities such as doctors, hospitals, nursing homes, diagnostic labs and attorneys routinely attempt to defraud the health insurance system…with devastating results.

How do they do it? In a number of ways, including:

- Billing health insurance companies for expensive treatments, tests or equipment patients never had or never received

- Double- or triple-billing health insurers for the same treatments

- Giving health care recipients unnecessary, dangerous, or life-threatening treatments

- Selling low-cost health insurance coverage from fake insurance companies

- Stealing medical information and using it to bill health insurance companies for phantom treatments

If health insurance fraud knocks on your door, these types of scams may leave you with medical debts, damaged credit ratings, falsified health records, a high level of stress and overpriced health insurance premiums…or the inability to get any health insurance at all.

So what can you do about it?

- Report it; then fight back!

- What to Watch For

- The first step to fighting health insurance fraud is keeping your eyes and ears open for abuse.

- Be especially watchful for providers who:

Charge your health insurance company for services you never received or medical procedures you don’t need

Give you prescriptions for controlled substances for no justified medical reason

Bill your health insurance company for brand-name drugs when you actually get generics

Misrepresent cosmetic or other health care procedures not usually covered by health insurance plans as covered

If you notice a health care provider doing any of these things, keep all supporting paperwork handy for reference, and then contact your health insurance company to let them know.

Then, if you’re a Medicare or Medicaid recipient, call the U. S. Department of Health and Human Services and report the abuse.

Finally, contact your state department of insurance or the local police.

Fighting Health Insurance Fraud

To keep yourself from falling victim to health insurance fraud, take the following steps to fight back:

* Check with your state insurance department to make sure your health insurance company is licensed in your state.

* Check out your health insurance company for consumer complaints, fraud convictions and bankruptcies through your state department of insurance.

* Keep detailed medical records.

* Carefully review your billing statements.

* Never sign blank insurance claim forms.

* Avoid salespeople offering free health services or advice.

* Protect your medical records and information.

* Make sure you know what your health insurance policy covers–and what it doesn’t.

* Never pay your health insurance premiums in cash.

* Be wary if you’re asked to pay a full year’s premium up front.

* Be on guard against medical providers claiming to be connected with federal programs or the government.

* Beware of health insurance companies offering you coverage at an unreasonably low price.

* Ask your health insurance provider about anything you don’t understand regarding your bills.

Making a Difference

Protect your right to health insurance, lower your premiums and keep your medical information safe. All it takes is a little education, a watchful eye, and the willingness to make a difference!

About InsureMe Penny Hagerman is a copywriter and insurance information expert with InsureMe in Englewood, Colorado. InsureMe links agents nationwide with consumers shopping for insurance quotes. Specializing in auto, home, life, long-term care and health insurance quotes, the InsureMe network provides thousands of agents with insurance leads every year. For more information, visit InsureMe.com.