Introduction

Fraud and scams can have a devastating impact on your finances, emotional well-being, and reputation. It’s essential to take the right steps to recover from these incidents and protect yourself from further harm. In this comprehensive guide, we’ll cover how to identify fraud and scams, the steps to take after you’ve been targeted, and strategies for prevention and protection in the future.

Table of Contents

- Understanding Fraud and Scams

- Immediate Steps to Take After Fraud or Scam

- Reporting Fraud and Scams

- Protecting Your Finances

- Restoring Your Reputation

- Emotional Recovery

- Prevention and Protection Strategies

- Conclusion

1. Understanding Fraud and Scams

Fraud and scams come in many forms, and it’s essential to recognize the different types to respond effectively. Here are some common types of fraud and scams:

- Identity theft: Someone steals your personal information and uses it without your permission.

- Phishing: Fraudsters send emails, texts, or phone calls pretending to be from a reputable organization to trick you into providing sensitive information.

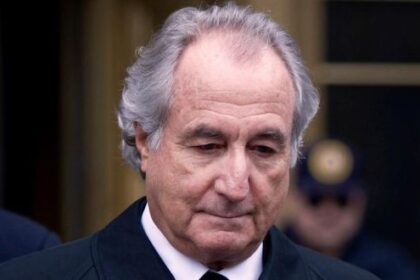

- Ponzi schemes: A type of investment fraud where returns are paid to existing investors with funds contributed by newer investors, rather than from profit earned.

- Romance scams: Scammers create fake online profiles and manipulate people into sending them money under the guise of a romantic relationship.

2. Immediate Steps to Take After Fraud or Scam

If you suspect you’ve been targeted by fraud or a scam, follow these steps immediately:

- Stop all communication with the scammer: Do not respond to any further messages or calls, and block their contact information.

- Change passwords and PINs: Update your login information for all online accounts, especially those related to your finances and personal information.

- Monitor your accounts: Keep a close eye on your bank, credit card, and other financial accounts for any suspicious activity.

- Freeze your credit: Contact the three major credit bureaus (Experian, Equifax, and TransUnion) to place a fraud alert or freeze on your credit reports.

3. Reporting Fraud and Scams

Reporting the fraud or scam is crucial for several reasons:

- It can help authorities track down and prosecute the criminals responsible.

- It can help you recover lost funds or minimize the financial damage.

- It raises awareness of the scam, helping prevent others from being targeted.

To report a fraud or scam, contact the following agencies:

- Local law enforcement: File a police report detailing the incident.

- Your country’s national fraud reporting center, such as the Federal Trade Commission (FTC) in the United States or Action Fraud in the United Kingdom.

4. Protecting Your Finances

Recovering financially from fraud or a scam can be challenging, but there are steps you can take to minimize the damage:

- Contact your bank and credit card companies: Inform them of the fraud, and ask them to close any accounts that have been compromised.

- Dispute unauthorized transactions: Work with your financial institutions to dispute any fraudulent charges or withdrawals.

- Keep records: Maintain copies of all correspondence, reports, and documents related to the fraud or scam for potential future legal action.

5. Restoring Your Reputation

Fraud and scams can damage your reputation and relationships. Take these steps to restore your credibility:

- Inform friends, family, and colleagues: Let those close to you know about the fraud or scam, so they’re aware of the situation and can support your recovery efforts.

- Correct misinformation: If the scammer published false information about you online, contact the website owner or administrator and request its removal.

6. Emotional Recovery

Being a victim of fraud or a scam can be emotionally distressing. Consider the following strategies for emotional recovery:

- Seek support: Reach out to friends, family, or a therapist to help you process your feelings.

- Join a support group: Connect with others who have experienced similar situations to share advice and encouragement.

- Practice self-care: Invest in your physical and mental well-being by exercising, eating well, and getting enough sleep.

7. Prevention and Protection Strategies

To protect yourself from future fraud and scams, follow these tips:

- Stay informed: Educate yourself about current scams and fraud techniques, and stay up-to-date on best practices for online security.

- Use strong passwords and two-factor authentication: Create unique, complex passwords for each of your online accounts, and enable two-factor authentication wherever possible.

- Be cautious with personal information: Never provide sensitive information, such as your Social Security number or bank account details, unless you’re confident the request is legitimate.

8. Conclusion

Recovering from fraud and scamscan be a challenging and emotional process. However, by taking immediate action, reporting the incident, protecting your finances, restoring your reputation, and focusing on emotional recovery, you can overcome this difficult experience. Implementing prevention and protection strategies will also help safeguard you from future threats, giving you the confidence to navigate the digital world safely and securely. Remember, you are not alone, and there are resources and support available to help you through this journey.