Stop Fraud in 2025: 20 Essential Prevention Tips

Stay one step ahead of scammers in the digital age. This comprehensive guide provides 20 actionable tips to protect yourself from identity theft, phishing scams, online shopping fraud, and more in 2025. Learn how to recognize and prevent fraud today!

In our increasingly digital world, fraudsters constantly evolve their tactics to exploit vulnerabilities. From identity theft to sophisticated online scams, the threat of fraud is ever-present. By understanding common fraud types and adopting proactive measures, you can significantly reduce your risk of becoming a victim.

20 Types of Fraud and Prevention Tips

- Identity Theft:

- Description: Fraudsters steal your personal information (like your name, Social Security number, or credit card details) to open new accounts or make purchases in your name.

- Tip: Regularly monitor your credit reports and bank statements for unauthorized activity. Consider a credit freeze or fraud alert.

- Phishing Scams:

- Description: You receive deceptive emails, texts, or calls that appear to be from legitimate organizations, tricking you into revealing personal information or clicking on malicious links.

- Tip: Be wary of unsolicited messages asking for personal information. Hover over links to check their destination before clicking.

- Online Shopping Fraud:

- Description: You make purchases from fake websites or encounter sellers who don’t deliver the goods or provide counterfeit products.

- Tip: Only shop from reputable websites and use secure payment methods. Look for “https” in the website address and a padlock icon.

- Credit Card Fraud:

- Description: Your credit card information is stolen and used to make unauthorized purchases.

- Tip: Never share your credit card information with anyone you don’t trust. Report lost or stolen cards immediately.

- Investment Fraud:

- Description: Fraudsters promise high returns with little to no risk, often pressuring you to invest quickly.

- Tip: Be cautious of “get-rich-quick” schemes and unsolicited investment offers. Research any investment opportunity thoroughly.

- Charity Fraud:

- Description: Scammers pose as legitimate charities to solicit donations.

- Tip: Research charities before donating and be wary of high-pressure tactics. Verify the organization’s legitimacy through independent sources.

- Romance Scams:

- Description: Scammers create fake online profiles to build relationships and then ask for money.

- Tip: Be cautious of online relationships that progress quickly or involve requests for money. Never send money to someone you’ve only met online.

- Elder Fraud:

- Description: Scammers specifically target older adults, often using tactics that play on their emotions or vulnerabilities.

- Tip: Educate elderly loved ones about common scams and encourage them to be cautious. Offer to help them review any suspicious communications.

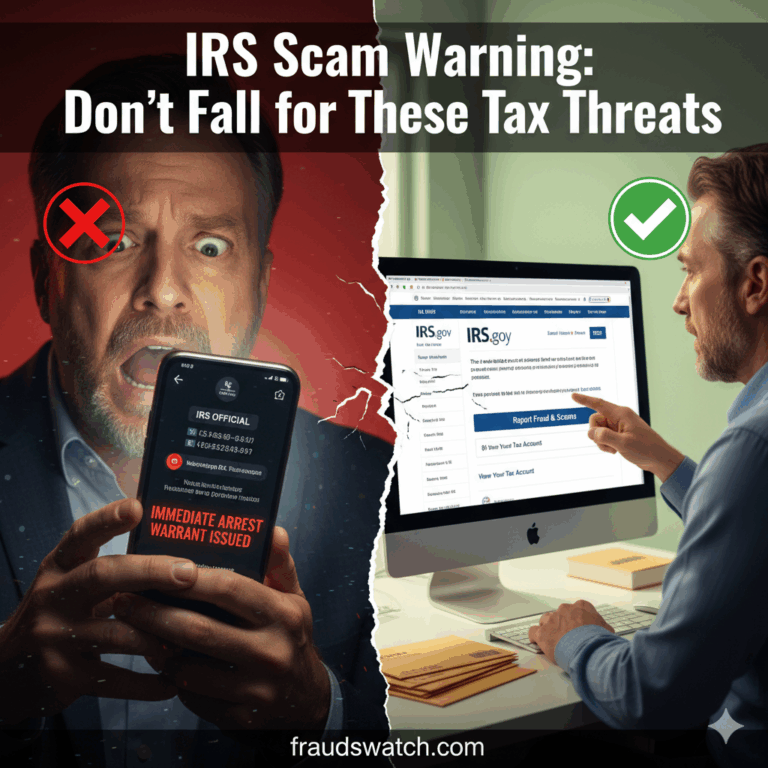

- Tax Fraud:

- Description: Individuals or businesses intentionally misrepresent their income or expenses to avoid paying taxes or to claim fraudulent refunds.

- Tip: File your taxes on time and be wary of anyone offering to help you get a larger refund than you’re entitled to. Use reputable tax preparers.

- Healthcare Fraud:

- Description: Providers or patients submit false or inflated claims to insurance companies for medical services or equipment.

- Tip: Review your medical bills carefully and report any suspicious charges.

- Insurance Fraud:

- Description: Individuals or businesses stage accidents or exaggerate injuries to collect insurance payouts.

- Tip: Be honest when filing insurance claims and report any suspected fraud.

- Employment Fraud:

- Description: Scammers pose as employers to collect personal information or money from job seekers.

- Tip: Be cautious of job offers that seem too good to be true or require upfront payment. Research the company and verify the job listing.

- Lottery Fraud:

- Description: You’re notified that you’ve won a lottery you didn’t enter, but you need to pay a fee to claim your prize.

- Tip: You can’t win a lottery you didn’t enter. Be wary of notifications claiming you’ve won a prize.

- Grandparent Scam:

- Description: Scammers pose as a grandchild in trouble and ask for money to be wired immediately.

- Tip: Verify any urgent requests for money from family members, even if they seem genuine. Contact the person directly using a known phone number.

- Tech Support Scam:

- Description: Scammers pose as tech support representatives and trick you into giving them remote access to your computer or providing personal information.

- Tip: Legitimate tech companies won’t call you out of the blue asking for remote access to your computer.

- Fake Check Scam:

- Description: You receive a check for more than the amount owed and are asked to wire the difference back to the sender. The check turns out to be fake.

- Tip: Don’t accept a check for more than the amount owed and never wire money back to the sender. Wait for the check to clear before spending any of the money.

- Rental Scam:

- Description: Fraudulent rental listings lure victims with low prices or attractive amenities, then request payment before viewing the property or provide fake keys/leases.

- Tip: Be cautious of online rental listings that seem too good to be true or require payment before viewing the property.

- Pyramid Scheme:

- Description: Participants recruit others into a business with the promise of high returns, but the scheme relies on constant recruitment rather than selling a legitimate product or service.

- Tip: Legitimate businesses focus on selling products or services, not recruiting new members.

- Business Email Compromise (BEC):

- Description: Scammers impersonate a company executive or vendor to request fraudulent wire transfers or changes to payment information.

- Tip: Verify any requests for wire transfers or changes to payment information, especially if they come from a high-level executive.

- Deepfake Fraud:

- Description: Scammers use AI-generated videos or audio recordings to impersonate someone and trick victims into providing personal information or money.

- Tip: Be skeptical of videos or audio recordings that seem too perfect or out of character for the person depicted.

10 More Fraud Prevention Tips for 2025

- Beware of QR Code Scams:

- Description: Scammers create malicious QR codes that, when scanned, redirect users to phishing websites or download malware onto their devices.

- Tip: Use a trusted QR code scanner app that previews the destination URL. Avoid scanning QR codes from unknown sources or in public places.

- Protect Your Social Media Accounts:

- Description: Fraudsters use social media to gather personal information or spread misinformation. They may create fake profiles or hack into existing accounts to target victims.

- Tip: Review your privacy settings, limit the information you share publicly, and be cautious about accepting friend requests from strangers. Enable two-factor authentication for added security.

- Be Mindful of Public Wi-Fi:

- Description: Public Wi-Fi networks are often unsecured, making it easier for hackers to intercept your data. They may use techniques like “man-in-the-middle” attacks to steal your login credentials or other sensitive information.

- Tip: Avoid accessing sensitive information or conducting financial transactions on public Wi-Fi. If you must use it, consider a virtual private network (VPN) for added security.

- Monitor Your Child’s Online Activity:

- Description: Children can be particularly vulnerable to online scams, cyberbullying, and predators. They may unknowingly share personal information or click on malicious links.

- Tip: Talk to your kids about online safety and monitor their online activity. Consider using parental control software to restrict access to inappropriate content and protect their personal information.

- Secure Your Mobile Devices:

- Description: Mobile devices contain a wealth of personal and financial information, making them attractive targets for thieves and hackers.

- Tip: Use strong passwords or biometric authentication to lock your mobile devices. Be cautious about downloading apps from unknown sources and keep your operating system and apps up to date.

- Verify Caller ID:

- Description: Scammers use “spoofing” technology to make it appear as if they’re calling from a legitimate organization, such as your bank or the IRS.

- Tip: Don’t rely solely on caller ID to verify the caller’s identity. If you receive a suspicious call, hang up and call back using a verified number.

- Be Wary of Unsolicited Offers:

- Description: Scammers often use unsolicited offers, such as free trials, prizes, or loans with unbelievably low interest rates, to lure victims into providing personal information or making payments.

- Tip: Be skeptical of unsolicited offers. Do your research and read the fine print before providing any personal information or making any commitments.

- Check Your Credit Report Regularly:

- Description: Regularly reviewing your credit reports allows you to spot errors or signs of identity theft early on.

- Tip: Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) at least once a year. Look for any errors or signs of fraudulent activity. You can get a free copy of your credit report from each bureau at AnnualCreditReport.com

- Use a Secure Password Manager:

- Description: Using strong, unique passwords for all your online accounts is crucial for protecting your information. A password manager helps you create and store complex passwords securely.

- Tip: Choose a reputable password manager and enable two-factor authentication for added security. Avoid reusing passwords across multiple accounts.

- Trust Your Gut:

- Description: Your instincts can be a powerful tool in identifying potential scams. If something feels off about a situation, don’t ignore it.

- Tip: If something feels off about a situation, trust your instincts. Don’t be afraid to say no or walk away. If you’re unsure about something, seek advice from a trusted friend, family member, or financial advisor.

Conclusion

In an era where digital transactions and interactions are the norm, safeguarding yourself against fraud is paramount. The 20 essential tips outlined in this guide empower you to take proactive steps in protecting your finances and personal information. From recognizing the red flags of phishing scams to securing your online accounts, knowledge is your strongest defense.

Remember, fraudsters are constantly evolving their tactics, so vigilance and staying informed are key. By adopting these preventive measures and trusting your instincts, you can navigate the digital landscape with confidence and minimize the risk of falling victim to fraud.

Let’s make 2025 the year we outsmart the scammers and protect our financial well-being!