Gerard Terry, Former Chairman Of The North Hempstead Democratic Party And Nassau County Board Of Elections Official, Indicted For Tax Evasion And Obstructing Internal Revenue Laws

Defendant Failed to Pay Over $1.4 Million in Federal Tax Due While Holding at Least Six Government Jobs

An indictment was unsealed today in the United States District Court for the Eastern District of New York charging Gerard Terry with tax evasion and obstructing the administration of internal revenue laws. Terry was arrested this morning and his arraignment is scheduled for Tuesday before U.S. District Judge Joanna Seybert at the U.S. Courthouse, 100 Federal Plaza, Central Islip, New York.

The charges were announced by U.S. Attorney Robert L. Capers of the Eastern District of New York, Acting Special Agent in Charge Kathy A. Enstrom, Internal Revenue Service-Criminal Investigation (IRS-CI), and William F. Sweeney, Jr., Assistant Director in Charge of the New York Field Office of the Federal Bureau of Investigation (FBI).

As detailed in the indictment and in other publicly filed court documents, Terry, an attorney licensed to practice in New York state, attempted to evade substantial income tax due and owed by him, despite earning income from numerous government and quasi-government positions in Nassau County, including the Democratic Party in the town of North Hempstead, the Nassau County Board of Elections, the Town of North Hempstead, the Long Beach Housing Authority, the North Hempstead Housing Authority, the Freeport Community Development Agency, the Roosevelt Public Library, the Village of Port Washington, and the Village of Manorhaven. Since January 2000, Terry has failed to pay a federal tax debt of over $1.4 million, despite earning over $250,000 per year.

During the period charged in the indictment, Terry routinely failed to file personal Form 1040 tax returns, filing years later and only after vigorous pursuit by the IRS. Even then, Terry filed Forms 1040 that contained false information and failed to report income. Moreover, Terry has still failed to file returns for tax years 2009 and 2010. Terry also evaded the IRS’s attempts at levy collection by cashing hundreds of wage and compensation checks worth over $500,000, rather than depositing them into checking or savings accounts where they could be seized. When depositing those checks into his bank account, Terry did so in the minimum amounts necessary to cover checks and payments for his own personal expenses and luxury items, thereby making sure there were insufficient funds upon which the IRS could levy.

In his communications with the IRS, Terry routinely provided false, misleading, and incomplete information to obstruct internal revenue laws. For example, Terry created and utilized a checking account in the name of a corporate nominee so as to conceal income and avoid levy collection. Additionally, Terry had one of his employers make direct payments to his credit card rather than issuing him a paycheck, allegedly to avoid levy collection by the IRS.

“As alleged in the indictment, the defendant knowingly and willfully refused to pay his federal income taxes. That he did so while earning hundreds of thousands of dollars from government and civic positions only makes his conduct more offensive,” stated U.S. Attorney Capers. “Today’s indictment demonstrates our resolve to aggressively investigate and prosecute those who fail to meet their income tax obligations under the law.”

“Taxes are inevitable, we all have to pay them. Mr. Terry allegedly tried to avoid paying them, especially egregious given his position and roles in government organizations which rely on taxes from citizens who work hard and obey laws,” said FBI Assistant Director in Charge Sweeney.

“As alleged in today’s indictment, not only did Mr. Terry fail to pay taxes and file tax returns for over a decade, after being steadfastly pursued by the IRS he continued with his flagrant disregard for our nation’s tax system by filing fraudulent tax returns,” said IRS-CI Special Agent in Charge Enstrom. “Fulfilling individual tax obligations is a legal requirement and those who willfully evade this obligation will be held accountable.”

The charges in the indictment are merely allegations, and the defendant is presumed innocent unless and until proven guilty.

The government’s case is being prosecuted by Assistant U.S. Attorney Artie McConnell.

The Defendant:

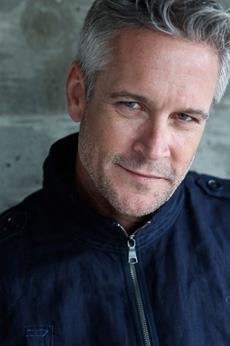

GERARD TERRY

Age: 62

Roslyn, New York

E.D.N.Y. Docket No. 17-CR-37