Tax Preparation Business Owner Sentenced To Prison For Defrauding The IRS

LAS VEGAS, Nev. – A man who operated tax preparation businesses in Nevada and Utah from 2004 to 2010, has been sentenced to 18 months in prison, three years of supervised release, and ordered to pay approximately $182,000 in restitution, for aiding and assisting in the preparation of multiple fraudulent individual income tax returns, announced U.S. Attorney Daniel G. Bogden for the District of Nevada.

“Unfortunately, there are persons with expertise in accounting and tax preparation who take advantage of less skilled or less educated persons who are trying to follow the law,” said U.S. Attorney Bogden. “We are continually working with the IRS to identify, investigate and prosecute these persons and to ensure that their businesses are shut down or cleaned up.”

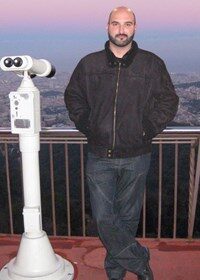

Roger Linares, 43, was sentenced by U.S. District Judge James C. Mahan. Linares pleaded guilty in July to one count of conspiracy to defraud the United States. Linares must report to federal prison by Jan. 13, 2017.

Another defendant charged in the scheme, Sergio Acosta, also pleaded guilty to one count of conspiracy to defraud the United States and was sentenced on Sept. 13 to five years of probation, six months of home confinement, and ordered to pay approximately $182,000 in restitution.

According to the guilty plea agreement, in October 2004, Linares and his wife opened a tax preparation business named America Services. By 2010, the business had 11 locations, including seven in Las Vegas, one in Mesquite, two in Salt Lake City, and one in St. George. They registered the business in Linares’ wife’s name because Linares did not become a U.S. citizen until approximately 2009. Linares actively participated in running the day-to-day operations of the business from 2004 to early 2010. The business established a large clientele consisting mostly of Hispanic individuals who spoke little or no English and possessed little tax knowledge. Those clients entrusted Linares and other employees at the business to accurately prepare their federal income tax returns. Linares aided and assisted in the preparation of at least 18 false individual income tax returns, but without the clients’ knowledge that the returns included false information that generated large refunds for the clients. Linares benefited from the large volume of customers because he was part-owner of the business and received a substantial portion of the proceeds. Other employees were paid commissions and the more returns they prepared, the more money they earned. The business was identified as having a 98 percent refund rate and substantial unreimbursed employee business expenses and questionable dependents. The total tax loss to the government for the 2008 and 2009 tax returns prepared by the defendants was $181,818.

The case was investigated by IRS Criminal Investigation and prosecuted by Assistant U.S. Attorney Lisa Cartier-Giroux.