(Date: April 8, 2025)

The digital marketplace is a marvel of modern convenience. With a few clicks, consumers can access a global bazaar, comparing prices, reading reviews, and having goods delivered directly to their doorstep. E-commerce has revolutionized retail, offering unprecedented choice and accessibility. Yet, beneath this shimmering surface of convenience lurks a persistent and evolving shadow: online fraud. Specifically, e-commerce fraud, encompassing everything from stolen payment details to entirely fabricated online storefronts, poses a significant threat to consumers and legitimate businesses alike.

Estimates suggest that global losses from e-commerce fraud run into the tens of billions of dollars annually, a figure that experts warn is likely conservative and continues to climb as online transactions surge. This isn’t just a financial drain; it’s an erosion of trust, the very currency upon which digital commerce is built. Every successful scam makes consumers more hesitant, potentially impacting the growth of legitimate businesses caught in the crossfire.

This article delves into the complex ecosystem of e-commerce fraud, focusing particularly on the pervasive issue of fake online stores. We will explore the tactics used by fraudsters, illuminate the warning signs consumers should heed, provide actionable steps for self-protection, and examine what happens when, despite best efforts, someone falls victim.

The Many Faces of E-commerce Fraud

E-commerce fraud isn’t a single entity but rather a spectrum of deceptive practices. Understanding the different types is the first step towards recognizing and avoiding them:

- Fake Online Stores: Perhaps the most brazen form, these are websites meticulously designed to mimic legitimate retailers or create entirely new, convincing-looking shops. Their sole purpose is to lure customers into making purchases, harvest their payment information and personal data, and then either disappear entirely, send counterfeit goods, or send nothing at all. These operations range from crude, easily spotted sites to highly sophisticated replicas that can fool even savvy shoppers.

- Payment Fraud (Card-Not-Present – CNP Fraud): This is the classic form where fraudsters use stolen credit or debit card details (obtained through data breaches, phishing, or malware) to make unauthorized purchases online. Since the physical card isn’t required, it’s a favorite among criminals.

- Phishing Scams: While not exclusive to e-commerce, phishing plays a major role. Fraudsters send emails or messages pretending to be from legitimate retailers, delivery companies, or payment processors. These messages often claim there’s an issue with an order, a delivery problem, or a suspicious account login, prompting the user to click a malicious link and enter their credentials or payment information on a fake website.

- Account Takeover (ATO): Criminals gain unauthorized access to a user’s legitimate online shopping account (often using credentials stolen in data breaches or guessed via weak passwords). They then change shipping addresses, make purchases using stored payment methods, or steal loyalty points and personal information.

- Identity Theft: Beyond just payment details, fraudsters may steal enough personal information (name, address, date of birth, social security number) to open new lines of credit or create entirely fake shopping profiles, perpetrating fraud under someone else’s name.

- Non-Delivery / Non-Payment Fraud: In non-delivery scams, a seller (often on marketplaces or fake sites) accepts payment but never ships the goods. Conversely, non-payment fraud involves a buyer receiving goods but falsely claiming they never arrived to get a refund, or using fraudulent payment methods that are later reversed.

- Chargeback Fraud (Friendly Fraud): A customer makes a legitimate purchase but then disputes the charge with their bank, falsely claiming the item wasn’t received, was defective, or the transaction was unauthorized. While sometimes genuine, this is increasingly exploited fraudulently.

- Triangulation Fraud: A more complex scheme. A fraudster sets up a fake (or sometimes legitimate-looking) storefront advertising goods at low prices. When a customer places an order, the fraudster takes their payment. Then, using stolen credit card details, the fraudster orders the same item from a legitimate retailer and has it shipped directly to the original customer. The customer receives their item, unaware of the fraud. The fraudster pockets the customer’s payment, and the legitimate retailer is eventually hit with a chargeback when the owner of the stolen card disputes the transaction.

- Counterfeit Goods Scams: Customers order branded goods, often at discounted prices, only to receive cheap, illegal knock-offs. These sites often look professional but deliver disappointment and potentially unsafe products.

Spotlight on Fake Online Stores: The Digital Mirage

The proliferation of fake online stores is particularly alarming due to the ease with which they can be created and the direct way they target consumers’ trust and wallets. Platforms offering easy website-building tools, combined with the anonymity afforded by the internet, have lowered the barrier to entry for scammers.

“Creating a convincing fake storefront is easier than ever,” notes ‘Eleanor Vance’, a cybersecurity analyst specializing in threat intelligence (name used illustratively). Scammers can clone legitimate websites, use high-quality stock photos, and leverage social media advertising to drive traffic. They often target periods of high demand, like holidays or major sales events, preying on shoppers looking for deals.”

How do these digital mirages operate?

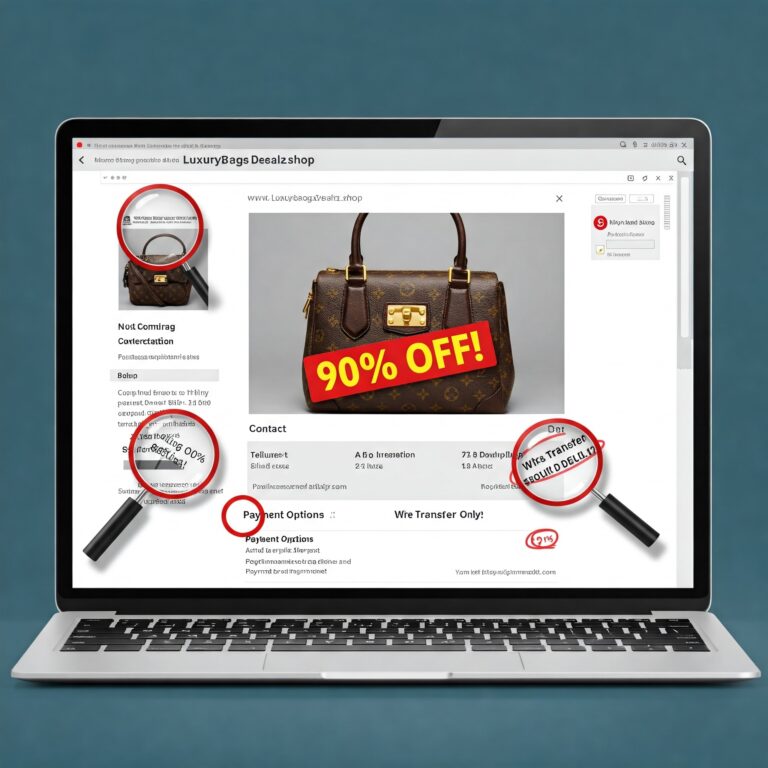

- The Lure: Unbelievably low prices are the primary bait. Discounts of 50%, 70%, or even 90% on popular or luxury items are common tactics. Scarcity (“Only 2 left!”) and urgency (“Sale ends in 1 hour!”) are often used to pressure buyers into making impulsive decisions.

- The Look: Many fake stores invest in professional-looking designs. They might steal logos, product images, and even website layouts from legitimate brands. However, inconsistencies often remain – typos, grammatical errors, low-resolution images, or slightly “off” branding are tell-tale signs.

- The Domain Name: Scammers often use domain names that are very similar to legitimate brands but with slight misspellings (typosquatting) or different extensions (e.g., .shop, .xyz, .top instead of .com). They might also use generic names combined with keywords like “deals,” “outlet,” or “official store.”

- The Disappearing Act: Once they’ve collected enough payments or sense detection is imminent, the website simply vanishes, leaving customers with empty pockets and no recourse.

Case Scenario: The Phantom Gadget Store

Imagine ‘TechDealsOutlet.shop’. It pops up in social media feeds, advertising the latest smartphone for 60% off. The website looks sleek, featuring familiar logos and product shots. Excited shoppers rush to grab the deal. They enter their names, addresses, and credit card details. Some might receive fake shipping confirmation emails. Weeks pass, but no phone arrives. Attempts to contact customer service go unanswered – the provided email address bounces, and the phone number is disconnected. The website itself eventually goes offline. The victims have lost their money and, worse, compromised their personal and financial data. This scenario plays out thousands of times daily across the globe.

Red Flags: Your Checklist for Spotting E-commerce Scams

Vigilance is the consumer’s best defense. Training yourself to spot the warning signs can save you significant trouble:

- If It Looks Too Good To Be True, It Probably Is: Extreme discounts are the biggest red flag. Legitimate retailers rarely offer genuine products at drastically slashed prices across the board.

- Scrutinize the Domain Name (URL):

- Is it the official domain (e.g.,

brandname.com) or something slightly off (brandname-deals.shop,officialbrand.xyz)? - Check for padlock icon and “https://” (secure connection), but remember even scam sites can have HTTPS now. It’s necessary, but not sufficient proof of legitimacy.

- Use domain age checker tools (like Whois lookup) – scam sites are often newly registered.

- Is it the official domain (e.g.,

- Website Quality and Content:

- Look for poor grammar, spelling mistakes, awkward phrasing.

- Check for low-resolution images, inconsistent design, or broken links.

- Is the “About Us” section vague or copied from elsewhere?

- Are product descriptions generic or stolen?

- Contact Information:

- Is there a physical address, a working phone number, and a professional email address (not a generic Gmail/Hotmail)?

- Try calling the number or mapping the address. Does it check out? Lack of verifiable contact info is highly suspicious.

- Payment Methods:

- Be wary if the only options are irreversible methods like wire transfers, cryptocurrency, Zelle, or gift cards.

- Legitimate stores offer standard options like major credit cards and PayPal, which provide better buyer protection. Insisting on only one, less secure method is a huge red flag.

- Policies (Return, Privacy, Shipping):

- Are these policies clearly stated, detailed, and fair?

- Check for inconsistencies, vague language, or policies copied directly from other sites (try searching a distinctive sentence). No policies at all is a major warning.

- Reviews:

- Don’t just trust reviews on the site itself – they can be easily faked.

- Search for independent reviews on third-party sites (Trustpilot, Google Reviews, BBB).

- Look for patterns: Are all reviews overly generic and positive? Are there sudden bursts of reviews? Are reviewer profiles suspicious? No reviews anywhere online for an established-looking store is also suspect.

- Social Media Presence:

- Does the store have linked social media profiles? Are they active and engaging, or just shells with few followers and little interaction? Check comments for complaints.

- Pressure Tactics: Beware of constant “limited time offer” banners, countdown timers that reset, or claims of extremely low stock designed purely to rush your decision.

Protecting Yourself: Best Practices for Secure Online Shopping

Beyond spotting red flags, proactive measures can significantly reduce your risk:

- Use Credit Cards: Credit cards generally offer stronger fraud protection and dispute resolution processes than debit cards or other payment methods. You’re disputing the bank’s money, not your own directly withdrawn funds.

- Avoid Public Wi-Fi for Purchases: Unsecured networks make it easier for criminals to intercept your data. Stick to trusted, private networks or use a VPN.

- Strong, Unique Passwords & Multi-Factor Authentication (MFA): Use a different, complex password for every online account. Employ a password manager. Enable MFA (two-step verification) wherever possible – this adds a crucial layer of security even if your password is stolen.

- Regularly Monitor Statements: Check your bank and credit card statements frequently for any unauthorized transactions. Report discrepancies immediately.

- Think Before You Click: Be skeptical of unsolicited emails or messages asking for information or urging you to click links, even if they look official. Go directly to the known website instead of clicking links in messages.

- Keep Software Updated: Ensure your operating system, browser, and antivirus software are up-to-date to protect against known vulnerabilities exploited by malware.

- Research Unknown Retailers: Before buying from an unfamiliar site, do your homework. Search for reviews, check their domain registration, look for complaints.

- Trust Your Instincts: If something feels off about a website or a deal, it’s usually best to walk away. There are plenty of legitimate retailers out there.

- Use Virtual Credit Card Numbers: Some banks or services offer virtual card numbers that are temporary or limited to a specific merchant, reducing the risk if the number is compromised.

The Merchant’s Side of the Battle

While consumers face direct financial loss and data compromise, legitimate e-commerce businesses are also major victims. They contend with:

- Chargebacks: Losing both the product shipped and the revenue when a fraudulent transaction is disputed. Excessive chargeback rates can lead to higher processing fees or even loss of merchant accounts.

- Reputation Damage: Fraud associated with their platform, even if perpetrated by third-party sellers or fraudsters impersonating them, can damage customer trust.

- Increased Operational Costs: Implementing robust fraud detection systems (using AI, machine learning, address verification, CVV checks, 3D Secure protocols) adds significant expense.

“It’s a constant arms race,” says ‘Ben Carter’, head of fraud prevention at a mid-sized online retailer (name used illustratively). “Fraudsters are continually adapting their techniques, exploiting new technologies and social engineering tactics. We invest heavily in multi-layered security, but vigilance is key across the board – from our systems to our customer service training.”

What to Do If You Become a Victim

Falling victim to online fraud can be distressing, but swift action is crucial:

- Contact Your Bank or Credit Card Issuer Immediately: Report the fraudulent transaction. They can block your card, reverse the charge (if possible), and issue a new card. The sooner you report, the better your chances of recovering funds and limiting further damage.

- Report the Fraud:

- File a report with relevant consumer protection agencies (e.g., the Federal Trade Commission (FTC) in the US via ReportFraud.ftc.gov, Action Fraud in the UK, or your national equivalent).

- Report the scam website to its domain registrar or hosting provider (you can find this via Whois lookup).

- If the fraud occurred on a legitimate platform (like eBay or Amazon), report it to them directly.

- Consider filing a report with your local police, especially if significant funds or identity theft is involved (though recovery chances may be low, it helps create a record).

- Change Passwords: If you used the same password on the scam site as elsewhere, change it immediately on all important accounts (email, banking, other shopping sites).

- Monitor Your Credit: Check your credit reports regularly for any signs of new accounts opened in your name or other indicators of identity theft. Consider placing a fraud alert or security freeze on your credit files.

- Scan Your Devices: Run a reputable antivirus/antimalware scan on your computer and mobile devices to ensure no malicious software was installed.

- Warn Others: Share your experience (cautiously, without revealing excessive personal detail) on social media or review sites to warn potential future victims.

The Future: An Evolving Battlefield

The fight against e-commerce fraud is ongoing. As technology evolves, so do the methods of both fraudsters and defenders.

- Artificial Intelligence (AI) and Machine Learning (ML): These are double-edged swords. Defenders use AI/ML to analyze transaction patterns, identify anomalies, and predict fraudulent activity in real-time. Fraudsters, however, are also leveraging AI to create more convincing fake websites, generate realistic phishing emails, and automate attacks.

- Biometrics: Fingerprint scanning, facial recognition, and behavioral biometrics (analyzing typing speed or mouse movements) are increasingly used to verify identity during login and checkout.

- Enhanced Authentication: Protocols like 3D Secure 2.0 aim to make online payments more secure through stronger customer authentication, often involving communication with the cardholder’s bank app.

- Regulation and Collaboration: Governments and industry bodies are continually working on stronger regulations and promoting information sharing between businesses, financial institutions, and law enforcement to combat fraud more effectively.

Conclusion: Empowerment Through Awareness

The convenience of online shopping is undeniable, but it comes with inherent risks. E-commerce fraud, particularly through fake online stores and sophisticated phishing schemes, remains a significant and growing threat in 2025. However, succumbing to fear is not the answer. Empowerment comes through awareness and vigilance.

By understanding the tactics fraudsters employ, learning to recognize the red flags, adopting secure online habits, and knowing what steps to take if compromised, consumers can navigate the digital marketplace more safely. Legitimate businesses, financial institutions, and technology providers must continue to innovate and collaborate in this ongoing battle. Ultimately, a safer online shopping environment benefits everyone – except the criminals hiding in the digital shadows. Shop smart, stay alert, and protect your digital self.